12 of the employees salary goes towards the EPF. With a current asset base.

Canada Health Act Annual Report 2016 2017 Canada Ca

The employer has the responsibility of paying EPF contributions for each employee under its employment.

. The monthly payment of EPF contribution comprising of both employees and employers share should be paid by the 15th of the month for the salary issued for the previous month. In a statement today in conjunction with the release of its Annual Report 2017 the EPF said there was also an 826 increase in total investment assets to. The annual report revealed a 638 per cent rise in annual EPF contributions to RM6552 billion against total withdrawal of RM4940 billion resulting in net inflows of RM1612 billion for 2017.

A HISTORICAL YEAR 2017 was a historical year for the EPF being the first year it started managing two retirement schemes ie. Whether you are formally or informally employed there is an option for you. Find out how you can grow your savings today.

Notification dated 9th April 1997 was issued enhancing Provident Fund contribution rate from 833 to 10. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years. R 1 000 x 12 R 600 x 12 R12 000 R7200.

500- EDLIS Administrative charges AC-22 0. 065 goes towards contribution for. Your annual taxable income before deductions is R 240 000 R 20 000 x 12 months.

This means your total retirement contributions for the year are. This step has been taken in view of recent implementation of Unified Portal by EPFO from 23 December 2016. EPFO has issued a notification dated 15032017 under which EPF admin charges has been reduced to 065 percent from 085 percent earlier.

It was also the first time we announced the financial results and dividend. Your contribution to EPF account is tax-deductible under Section 80C of the Income Tax Act. Ministry of Labour and Employment decided to reduce PF administrative charges payable by employers.

EPF Employee Contribution Rate effective 01032016 - 31122017. 15 of 1958 and is currently the largest Social Security Scheme in Sri Lanka. For late contribution payments employers are required to remit contributions in accordance with the third schedule as attached below by referring to the applicable effective date.

If your employer fails to deduct your salary for EPF contributions at the time your salary is paid your employer cannot recover the contributions from you. 833 goes towards contribution for EPS. EPF today released its Annual Report 2017 which was tabled in Parliament on 3 April 2018.

KUALA LUMPUR 13 April 2018. With this 172 categories of. Submitting their employees EPF contribution details online as well as making online payments.

The Employees Provident Funds EPF annual contributions for 2017 rose by 638 per cent to RM6552bil against a total withdrawal of RM4940bil resulting in net inflows of RM16. The new rate of 065 percent is applicable on contribution for. The Employees Provident Fund EPF with the approval of the Minister of Finance today declared a dividend rate of 690 per cent for Simpanan Konvensional 2017 with payout amounting to RM4415 billion.

KUALA LUMPUR 10 February 2018. Anyone can contribute to EPF to grow their retirement savings. The retirement fund body had in March decided to pay an 81 per cent rate of interest on the provident fund deposits for the.

05 goes towards contribution for EDLI. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. Minimum Administrative charges payable per month per establishment is Rs.

A late payment charge or a dividend will be imposed if the EPF contribution is not paid on time. Whereas the employers contribution is divided as below. 367 goes towards contribution for EPF.

Know How steps in a few scenarios in accordance to the above legal change. EPF Rate 1316 W. KUALA LUMPUR April 13.

01042017 to 31052018 065 On total pay on which contributions are payable. You can make sure all your details in your Account Statement or i-Akaun Member are correct such as. Earlier EPFO had reduced the charges from 110 percent to 085 percent from 01012015.

065 From 01042017 Previous-085 from Jan 2015 or min Rs. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private. The Employees Provident Fund EPF was established under the Act No.

2 days agoThe decision will impact about five crore subscribers of the Employees Provident Fund Organisation EPFO. 14 0 RAJ KUMARI Friday April 14 2017 Edit this post. Simpanan Konvensional and Simpanan Shariah.

You will get this tax benefit under section 80C on the extra contribution as well. Youre limited to the total of your actual. For contribution to be paid by the employers for the month of December 2016 a grace period of 5 days has been granted by Employees Provident Fund Organisation by extending due date for payment of EPF Contribution by 20 th Jan 2017.

The Employees Provident Fund. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. It is also decided not to collect Administrative charges towards EDLI contributions.

This means that you can claim a tax deduction of up to R 66 000 275 of R 240 000. A employees who are Malaysian citizens. And 640 per cent for Simpanan Shariah 2017 with payout amounting to RM398 billionIn total the payout for 2017 amounts to RM4813.

Break-up of the EPF contribution. As per gazette notification issued on 15th March 2017 new rate of contribution towards PF administrative charges will 065 of total EPF wages of an employee. Governed under the Employment Insurance System Act 2017 and.

Annual contributions to the Employees Provident Fund EPF rose 638 to RM6552 billion versus total withdrawal of RM494 billion in 2017 resulting in net inflow of RM1612 billion. Employers are required to remit EPF contributions based on this schedule. Mac 2016 salarywage up to December 2017 Effective from 1 August 2013 to February.

This KBA 2484659 was created specially to elaborate on the above legal change on top of the SAP solution Note.

Voting Intentions For Coalitions October 2017 To February 2018 Download Scientific Diagram

30 Nov 2020 Bar Chart Chart 10 Things

How To Write A Defamation Of Character Letter Luxury Apologize Or I Ll Sue You For Defamation Of Character Defamation Of Character Character Letters Lettering

Nearly 48 Mn New Subscribers Joined Epf Scheme During 2017 21 Business Standard News

Bernama On Twitter Infographics Annual Report Epf 2017 Https T Co Nkywktvguf Twitter

4 9 Crore New Subscribers Joined Epf Scheme During Sept 2017 Nov 2021

What Is Gst Annual Returns I E Gstr 9 Gstr 9c Paying Taxes Acting Annual

Clarifications On Children Education Allowance Cea During Lockdown Period Dopt Om 01 07 2021 Kids Education Education Allowance

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

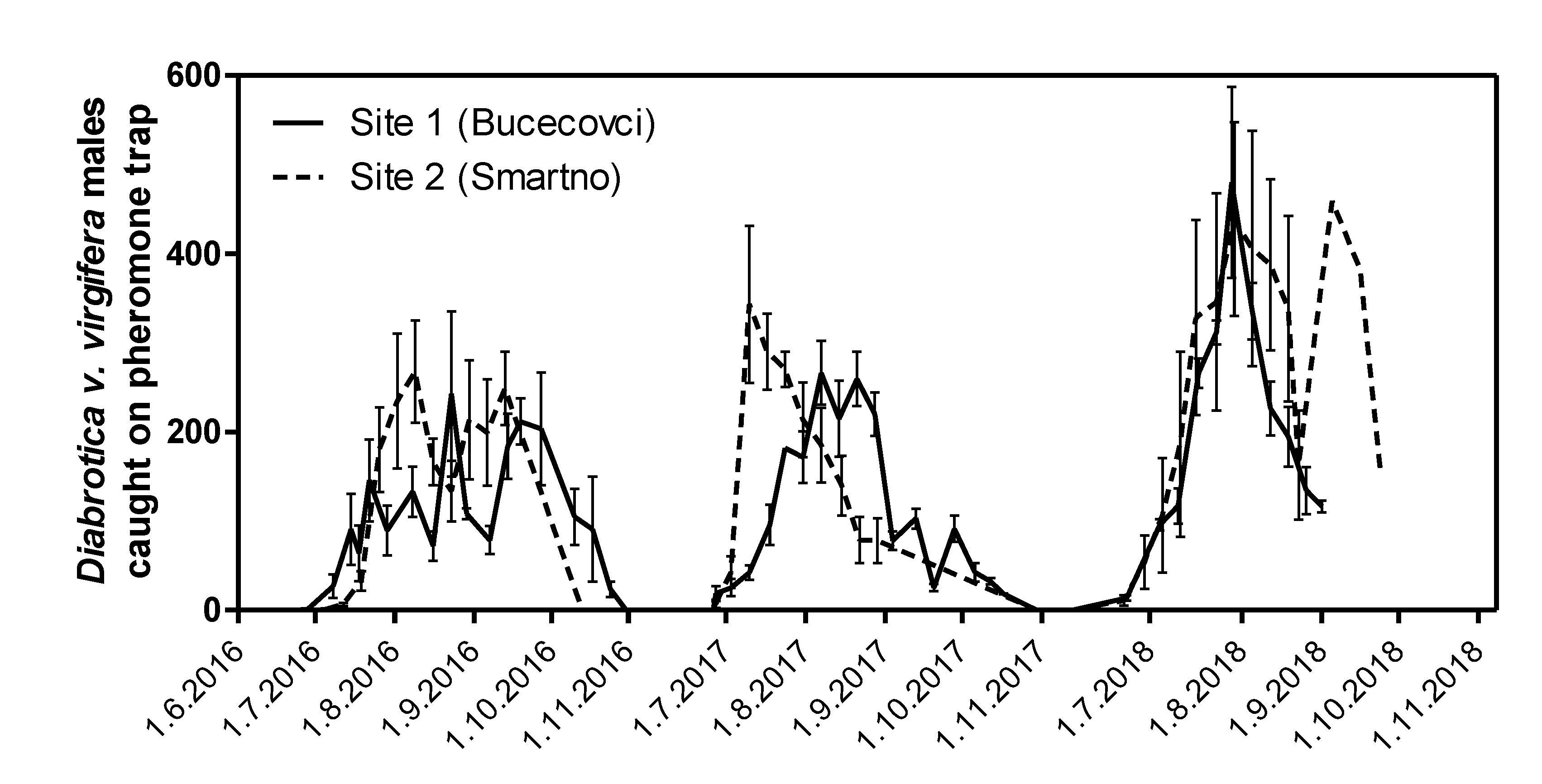

Insects Free Full Text Evaluation Of The Field Efficacy Of Heterorhabditis Bacteriophora Poinar Rhabditida Heterorhabditidae And Synthetic Insecticides For The Control Of Western Corn Rootworm Larvae Html

Confluence Mobile Community Wiki

Check Indian Bank S Holidays 2020 List Here Bank Of India Car Loans Yes Bank

8 Mac 2021 Commercial Marketing D I D

Growth In Epf Subscriptions And Scale Of Operations Over The Years As Download Scientific Diagram

National Pension Scheme Nps Why It Is Not A Good Investment Option Investing Investing Money Pensions

Epfo Portal Filing Taxes Private Limited Company Online Registration

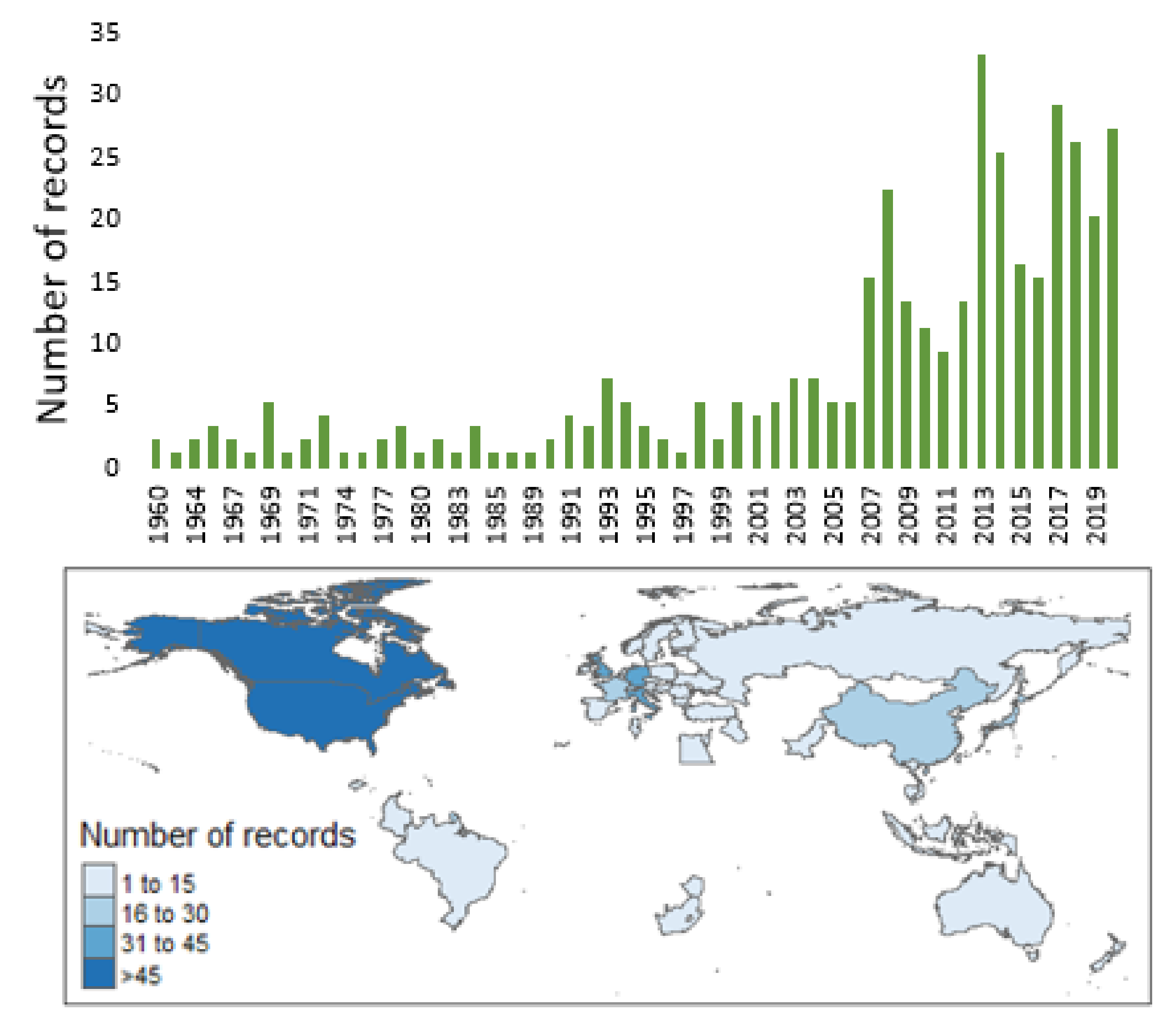

Agriculture Free Full Text Alternative Strategies For Controlling Wireworms In Field Crops A Review Html

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Our Team Of Expert And Qualified Financial Planners Help You To Develop A Sound Strategy To Ensure You Meet All Your Financial Financial Investing Life Values